Introducing: The Tillamook Chamber Chatter Podcast

At the Tillamook Chamber, we believe every business has a story worth telling. These are the stories of passion and purpose that shape our local economy and define the unique spirit of what makes Tillamook County so great. We’re excited (and a little nervous) to announce the launch of our new podcast, Tillamook Chamber Chatter Podcast, a platform dedicated to sharing these incredible stories with you in a relaxed conversation style interview!

In today’s fast-paced world, it can be hard to truly connect with the people who make our community thrive. We created this podcast to bring those conversations directly to you, whether you’re commuting to work, enjoying a walk, or relaxing at home. Our mission is simple: to shine a spotlight on our Chamber members—the businesses, organizations, and individuals who are the heart and soul of Tillamook County.

Each episode will feature a conversation with a different member, allowing them to share their journey of coming to be a business owner here in Tillamook County. You’ll hear about their successes, the challenges they’ve overcome, and the big ideas that drive them. By connecting you with the people behind our local businesses, we hope to foster deeper relationships, spark new collaborations, and celebrate the innovative spirit that makes Tillamook County truly special.

Beyond showcasing our wonderful members, we’ll give you a behind-the-scenes look at the Tillamook Chamber. Tune in for insights into our latest initiatives, key projects, and our ongoing efforts to support local business growth and community development.

We invite you to tune in! Find and subscribe to the Tillamook Chamber Chatter on Apple Podcasts and Spotify. Our first full episode drops mid-October!

Support Local and Win This Holiday Season

The holiday season is just around the corner, and we can already feel the excitement! This year, skip the last-minute shopping panic and get a head start on your gift list. By shopping small, you can support our local community, find unique gifts, and make a big difference right here at home.

And here’s a challenge from us at the Chamber: get out there and discover a new-to-you Tillamook County shop you’ve never explored before! You might be surprised by the amazing, one-of-a-kind items you find—the perfect fit for someone on your list.

The Shop Small Sweepstakes is the perfect way to turn your shopping trips into winning opportunities! From October 1st to December 31st, every time you shop at a locally-owned business in Tillamook County, you’ll be entered to win a weekly gift card or the grand prize of $1,000 in Sweepstakes Bucks.

This isn’t just about winning prizes; it’s about investing in the heart of our community. When you shop locally, you’re directly supporting your neighbors, friends, and family. It’s an easy way to help our community thrive, especially during the slower seasons.

We want to give a huge thank you to this year’s generous sponsors: Oregon Coast Bank, JLT Construction, and Sand Dollar Restaurant and Lounge, for making this possible!

How to Enter

Ready to get started? It’s simple.

- Shop Local: Make a purchase at any locally-owned business in Tillamook County. Every coffee run, dinner out, or gift purchase(for yourself or others) counts!

- Save Your Receipts: Your receipts are your ticket to winning. You can enter one receipt per day, every day of the sweepstakes.

- Enter to Win: Choose one of two easy ways to enter:

- Drop off your receipt at the Chamber HQ, located at 208 Main Avenue in downtown Tillamook.

- Snap a photo of your receipt and text it along with your name to 503-664-0017.

Stay in the Loop

Curious about who’s winning and what’s happening? Be sure to follow the Chamber on Facebook. You can also join the Shop Tillamook Facebook group to discover special deals from local businesses and share your finds with fellow shoppers.

The sweepstakes officially kicks off on Wednesday, October 1st. If you have any questions, feel free to contact the help desk at the Chamber HQ at 503-842-7525.

Let’s make this holiday season special by celebrating our community and shopping small!

The Value of Mornings on Main

From updates to community connections, Mornings on Main is your monthly snapshot of what’s happening in Tillamook County.

Do you ever see our monthly reminder for Mornings on Main and wonder what it’s all about? While the promise of fresh, hot coffee is a great reason to join us here at the Chamber HQ’s on the third Tuesday of each month, this gathering is so much more than a morning snack. It’s a chance to get a real-time, in-the-moment scoop on what’s happening in and around our county.

Mornings on Main is a very engaging way to connect and learn directly from fellow business owners, non-profits, and community leaders. We kick off at 8:00 a.m. and go around the room, giving each person one to two minutes to share any upcoming events, sales, or information. There are no formal speakers; the spotlight is on you! We usually try to wrap it up at 9:00 a.m. so you can buzz out of here to carry on with your day, or stay and network.

You’ll be amazed by the variety of information shared. One month, a local realtor might provide a quick update on the housing market, followed by what’s playing next at the Tillamook Coliseum and details about an upcoming fundraiser. The next month, you could hear about upcoming emergency preparedness drills, new classes at a local dance studio for all ages, or an inspiring story from a non-profit about their work with veterans. The topics are always different and reflect a true cross-section of Tillamook life, making every gathering unique.

The best part is watching new connections form. Someone might share a need for volunteers, and you’ll see another person’s face light up with a solution. The conversations over coffee after the round robin style often lead to new partnerships, friendships, and great collaborations. There’s something special about being face-to-face with others who share the same common goal- a thriving community. If you’re curious to see it for yourself, join us on the next third Tuesday. It’s an easy, low-pressure way to get connected and see what makes our community so special.

We are incredibly grateful for our lead sponsor, Matt Cole from DirectLine-IT. His ongoing support is what makes this event possible, and we truly appreciate his generosity.

And for all that delicious, hot coffee you enjoy each week, we have the team at Starbucks of Tillamook to thank! They generously keep us all caffeinated.

If you have any questions about Mornings on Main feel free to reach out to Meg at meg@tillamookchamber.org for more details.

Second Main Street Grant to Revitalize Downtown Tillamook

I’m sure you’ve noticed the eye catching transformation happening on the corner of Pacific Avenue and Second Street, adjacent to the Henson Plaza as you make your way through downtown Tillamook. The historic National Bank Building has received a fantastic new facelift, thanks to the vision of local business owner and developer, Terry Philips. After a complete renovation, the building has a fresh new look. The clean white and gray paint job and new retail/ office space are just the beginning of some really exciting news for Downtown Tillamook.

Earlier this year, the Tillamook Chamber of Commerce applied for an Oregon Main Street Revitalization Grant on behalf of Terry’s project. We were thrilled to learn that we secured a substantial $250,000 to help get this project going and address a critical need here in Tillamook.

So, what exactly does that mean for our community? This grant will be a huge help in transforming the upper floor of the National Bank Building into new apartments, including an ADA-accessible unit on the bottom level that will be easily accessible from Pacific Avenue. We all know how critical the need for housing is, and this project is a big step toward addressing that.

Some of you might remember that the Oregon Main Street Revitalization Grant Program also helped another local business owner and developer, Lisa Greiner, owner of the Oregon Coast Dance Center. She was awarded $200,000 from the OMSRGP in 2019 to kick-start her downtown housing project. After a lengthy but rewarding renovation, the Jones-Knudson apartments above her dance studio were finished and fully occupied earlier this year. The Chamber celebrated with Lisa and those involved in the process during a ribbon cutting ceremony to officially commemorate the completion of this project on February 8th, 2025. This milestone’s success is a powerful example of how these grants can boost vitality in the downtown community.

The Chamber is honored to play a role in working with these motivated developers. We love helping them secure the funds needed to turn their passion and vision into a reality, making downtown Tillamook a more inviting and thriving place to live, work, and play. There’s nothing better than seeing a great idea become a reality while also meeting a real need in our community.

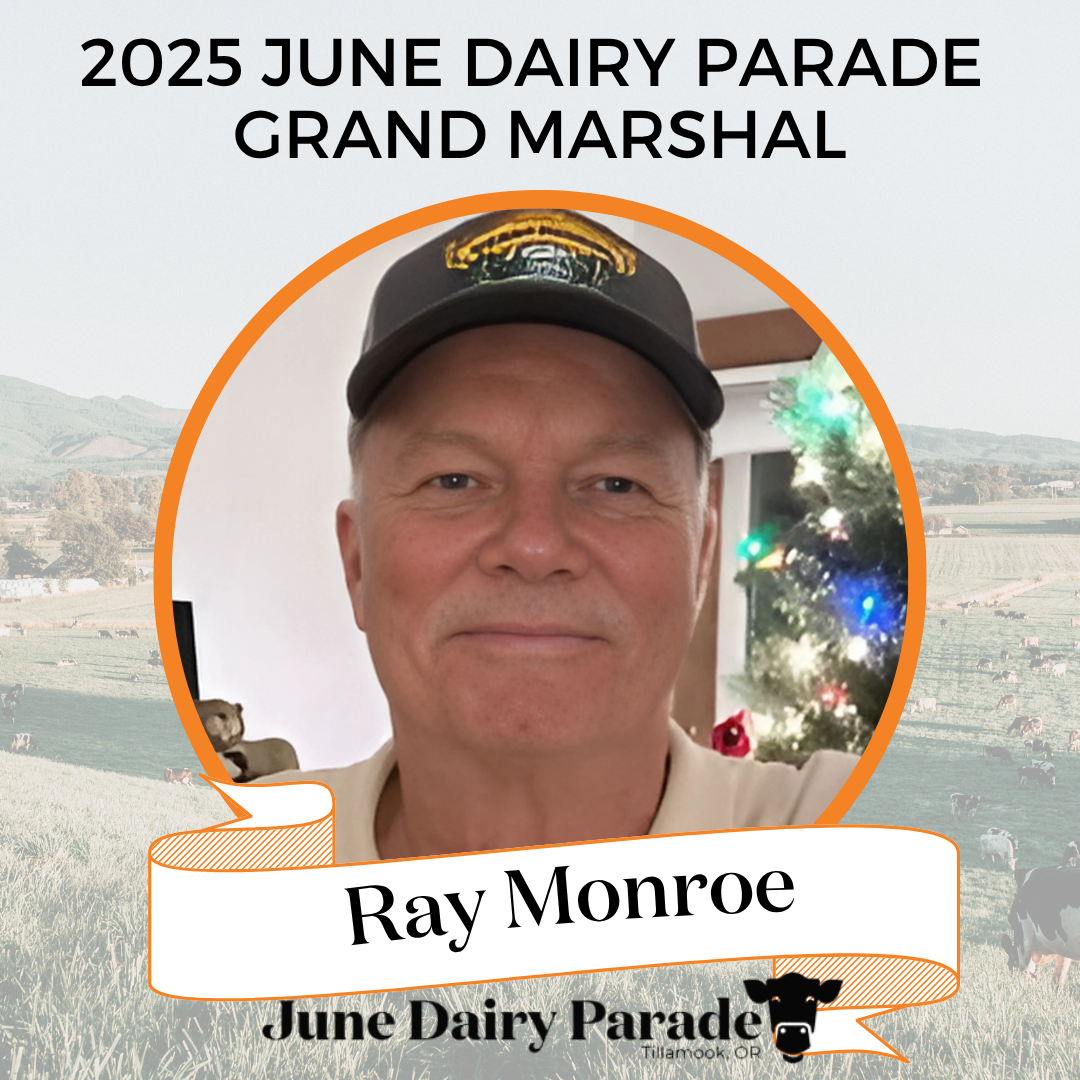

Ray Monroe Named Grand Marshal of 2025 June Dairy Parade

Ray Monroe, a lifelong Tillamook County resident and dedicated advocate for natural resources and the agricultural community, has been named the Grand Marshal of the 2025 June Dairy Parade. Ray’s deep roots in the county and extensive contributions to the local dairy industry and community make him a fitting choice for this honored role.

A Sandlake, Oregon native, Ray grew up immersed in the local fishing and farming communities, attending Beaver Grade School and graduating from Nestucca High School. He helped raise six children, the youngest of whom recently graduated from college.

Ray’s most significant professional contributions have been to the Tillamook County dairy industry. Since 1996, he has served with the Tillamook County Soil and Water Conservation District (SWCD). In this role, he plays a crucial part in distributing Farm Bill funds to natural resource users across Tillamook County. He works hand-in-hand with dairy farmers, assisting them in developing and implementing comprehensive farm plans. Furthermore, Ray is instrumental in securing grant funding that empowers dairy farmers to protect, improve, and care for natural resources, ensuring their sustainability for future generations.

As an advocate for landowner rights, Ray firmly supports the right to farm while simultaneously guiding landowners in complying with crucial Federal, state, and local regulations. His balanced approach shows his commitment to both agricultural prosperity and environmental stewardship.

Ray’s commitment extends far beyond his professional life, encompassing a wide array of activities and community involvements. He is an active member of the Pacific City Dorymen’s Association, the Pacific Fishery Management Council, the ODFW Restoration and Enhancement Board, the Oregon Coastal Zone Management Association, and the Ocean Policy Advisory Committee. His dedication to local agriculture is evident through his involvement with the Oregon Salmon Commission, the Tillamook Working Lands and Waters Cooperative, and the Oregon Farm Bureau. Demonstrating his compassionate spirit, he has also volunteered with the Oregon and Tillamook food banks and has been a key participant in distributing Christmas baskets in the past.

When not tirelessly working for the community, Ray enjoys the simple pleasures of coastal life including dory fishing, clamming, crabbing, and gardening. These pursuits connect him deeply to the natural beauty and resources of Tillamook County.

Congratulations, Ray!!

New Salary Threshold for Overtime Rule Finalized

brought to you by Cascade Employers Association

The Department of Labor (DOL) announced a new salary threshold that increases the minimum annual salary for exempt positions from $23,660 ($455 per week) to $35,568 ($684 per week). According to the DOL, this threshold is estimated to make 1.3 million American workers eligible for overtime pay under the Fair Labor Standards Act (FLSA). A similar change was supposed to take effect in 2016, but the rule was enjoined at the last minute before the effective date.

As we saw with the 2016 rule, employers can include up to 10% of an employee’s salary from non-discretionary bonuses, incentives and commissions in meeting the salary threshold. These payments must be paid at least annually. There will be no changes made to the FLSA’s “duties test.” This rule will take effect January 1, 2020.

Employers should start reviewing their compensation structures for the impact this will have. Employers may need to increase employee salaries, move some employees from exempt to nonexempt and consider any overtime they may now accrue, look at incentive options, restructure work to eliminate or minimize overtime, or a combination of these actions.

Employers should also watch out for wage compression which can occur if employers increase employee pay and salary range minimums, similar to what happened when Oregon changed its minimum wage law.

If your organization needs to evaluate its salary structure for the new overtime rules, Cascade is here to help. We offer extensive compensation services to ensure your organization is competitive and compliant.

Ribbon Cutting Ceremony Aug. 7th

Last year, Marlene Putman, administrator, Tillamook County Community Health Centers, had a glint in her eye and a very big idea. This idea was fueled by the vision of the patient-driven Community Health Council and their a passion for improving patient access. Today, she is proud to announce a new member of the team that arrived by special delivery earlier this month.

“We are so proud to announce our new team member, which has yet to be named. But she came in at a whopping 22,000 lbs. She is 39 feet long and 12 ½ feet tall,” said Putman. “And she’s a real beauty. I know that everyone who meets her will really love her.”

“We are very proud to announce the arrival of our new mobile community health center,” said Putman. “We can’t wait to get her ready to start delivering dental, physical and behavioral health care to Tillamook County,” said Putman.

Please join the Tillamook County Community Health Centers to meet their newest family member at the Ribbon Cutting Ceremony from 2 – 4 p.m. on Wednesday, Aug. 7, 2019, at Tillamook Bay Community College, 4301 Third St., Tillamook.

Please RSVP to Donna Gigoux at dgigoux@co.tillamook.or.us.

Performing Pianist Building Bridges Between Artists and Communities

by Jill Timmons

It’s New Year’s Day and I am looking out on the beautiful Netarts Estuary. I’m excited to begin 2019, and here in Tillamook. I moved here three years ago to anchor my company in Oregon and to live close to nature. Although I am a fourth generation Oregonian, I have lived in various places throughout the US as well as in France. But the central Oregon coast beats them all!

Through my company, Artsmentor, LLC, I work as a performing artist (pianist), music educator, consultant, and author. I also enjoy grant writing and assisting non-profits. My company works mostly throughout the US but occasionally in France. My mission is to build bridges between artists and communities, bringing the power and inspiration of music to all ages, all cultures, and all locales, and to foster a thriving environment for the performing arts.

There are two things that can bring people together, and promote understanding, sometimes almost instantaneously: music and food. When we enjoy the music or cuisine of a community or locale, we can learn a lot from the foods and preparation from that particular region. Think of our own county. Where else can you get the best oysters?! When you partake of this special delicacy, you know that Netarts has been home to this harvest back to the Native American communities that were first here.

Music is much the same. If you visit the rugged Atlantic coast of Brittany, France, for example, you will find an ancient seafaring culture—much like on the Oregon coast. The Breton people are known for their heartfelt sea shanties and distinctive bagpipe and oboe. And of course their cuisine is filled with fruits de mer (seafood), just like here in Tillamook.

I grew up spending my summers in a modest cabin with my family in Manzanita. In those days, Manzanita was a one-horse town. When we weren’t exploring the local community, we were fishing out of Tillamook Bay. I still get a thrill landing a big salmon! My dad and I were even rescued at sea by the Coast Guard. But that’s another story…

These days in Tillamook, we are experiencing a wave of exciting growth and development in our community. Just think of Highway 101. All things are possible! I am proud to live here, to anchor my business in this community, to meet so many vibrant and entrepreneurial people, and to be a member of the Chamber of Commerce. I hope you will join me next September for the second annual Piano Arts in Netarts music festival. Our opening concert is September 5. All events are held at the Netarts/Oceanside Firehouse and the Tillamook Chamber of Commerce website will have details in a few weeks. This opening concert, by the way, is free and open to the public and will also serve as a freewill offering for the Firehouse rescue efforts in our community.

It’s stopped raining and the tide is out. Time for a walk to Oceanside!

Jill Timmons has performed internationally as both a solo pianist and ensemble artist and has offered performances and educational residencies on three continents. Timmons, has been a featured artist on National Public Radio, has performed under the auspices of the National Endowment for the Arts and has recorded on the Laurel, Centaur, and Capstone labels. Ken Burns chose music from her Amy Beach recording for the soundtrack to his PBS documentary, The War. She received an NEA fellowship award for the recording of the complete works for solo piano by American composer, William Bergsma. As an award-winning author, Timmons has written on topics that include entrepreneurship, and volunteerism within the arts and humanities. She is a recipient of the Wilk International Literary Prize from University of Southern California. In 2013, Oxford University Press published her career guidebook: The Musician’s Journey: Crafting Your Career Vision and Plan. Timmons holds the Doctor of Musical Arts degree from the University of Washington and is professor emerita at Linfield College. Currently, Timmons is an artist/teacher affiliate with Classic Pianos at their flagship Portland store and in their affiliate locations in Bellevue, Denver, Anchorage, Las Vegas, Boston, and Albuquerque. When she isn’t making music, you will find her exploring the natural wonders of Tillamook County.

Celebrate the Bounty of the Bays Feb. 23

Twenty-five years ago Tillamook Bay was designated as a “Bay of National Significance” by the Environmental Protection Agency. This designation secured Tillamook Bay’s spot in the National Estuaries Program, which works to protect and restore the water quality and ecological integrity of 28 estuaries located along the Atlantic, Gulf and Pacific Coasts and Puerto Rico.

To celebrate this milestone with the community and the work being done to develop and implement science-based, community-supported management plans for all of Tillamook County’s estuaries and watersheds, the Tillamook Estuaries Partnership (TEP) invites the community to its Celebrate the Bounty on the Bay event at Pacific Restaurant on Feb. 23.

“This is a great chance to come meet the TEP staff, learn about water quality trends within our five estuaries, and the habitat restoration work that’s being done that’s beneficial to our fish and supports healthier fisheries,” said Chris Knutsen, Board President for TEP. “All while enjoying an extravagant seafood feast prepared by some of the best chefs in the region.”

Knutsen noted that traditionally TEP has hosted a premier fishing tournament that also served as their annual fundraiser, but this year the Board of Directors decided to switch things up a bit.

“Bounty on the Bay has traditionally been a fishing tournament,” he explained, “but with Chinook fisheries being at a lower abundance level for the next few years, we felt it was a good opportunity to expand the event and diversify our audience a bit more.”

Knutsen said they still hope that anglers and outdoor enthusiasts will join them on Feb. 23, as well as anyone and everyone who supports the idea of healthy watersheds.

“A lot of people who live in Tillamook County or visit our area don’t realize all the work TEP is doing on their behalf and for fish and wildlife resources,” Knutsen said.

Participants will be treated to a fabulous happy hour at Pacific Restaurant with fun trivia, prizes, a seafood dinner and a silent auction full of action-packed adventures.

“These are experiential-type opportunities that folks can bid on and help support TEP, and in turn allows them to get outside and see some of the area of Tillamook County that we serve and have an adventure while they’re out there,” Knutsen noted.

It’s also a chance for TEP to share their 2018 Year in Review and encourage the community to get involved with the protection and conservation of Tillamook’s five watersheds.

Tickets to the seafood feast and silent auction are only $60 for individuals or $330 for a table of six or $400 for a table of eight. You can purchase tickets on Eventbrite.com or at TEP’s website: www.tbnep.org. Ticket prices include two beer or wine drink tickets per person. Other drinks will be available for purchase at the bar. Limited tickets are available, and those interested are encouraged to purchase their tickets in advance.

If you’d prefer to not indulge in the seafood feast, the community is welcome to attend the 2018 Year in Review from 4 p.m. – 5 p.m. that night free of charge. Find a full schedule for the evening on the Tillamook Estuaries Partnership’s Facebook page.

The evening is made possible thanks to generous sponsors including: Visit Tillamook Coast; The Headlands Coastal Lodge & Spa; Wood & Moore Construction Inc.; Pacific Byway Development Company; Pacific Restaurant; and Pacific Seafood.

If you are interested in becoming a sponsor for Celebrate the Bounty on the Bay, or would like to help support TEP’s work with a donation to the silent auction, please contact Kristi Foster at 503-322-2222 or email kristi@tbnep.org.

Tillamook PUD Offers Community Grants in 2019

TILLAMOOK, OR – January 22, 2019- Tillamook PUD is offering a Community Support Grant program to local non-profit organizations with projects promoting economic growth and community livability in Tillamook County.

Organizations interested in applying for a grant must complete and submit an application by February 22, 2019. Applications are evaluated by the PUD Board of Directors, with final project selection in mid-March.

During evaluation, the Board considers each project and its potential for economic development, outreach into the community, and financial need. Projects must be completed by the end of the 2019 calendar year.

Individual grant awards will not exceed $10,000 and will not be awarded to the same entity more than twice in a five-year period. Some examples of past projects that have received grant funds include lighting and electrical upgrades at various civic organizations, purchasing updated energy efficient appliances for community facilities, and supporting improvement projects at local organizations utilized by the community.

Grant applications and procedures are available from Tillamook PUD or on its website at www.tpud.org/news-community/community-support-grants/.

Food Innovation Center comes to Tillamook County to conduct Recipe to Market workshops

January 11, 2019. Tillamook County, Oregon. Got an idea for a food product? Sign-up for Recipe-to-Market workshops.

Tillamook County is home to several national and regional food brands: Tillamook Cheese, Tillamook Country Smoker, Werners, Pacific Seafoods, Pelican Brewing, deGarde Brewing and Jacobsen Salt. There is room for more, and one way to get a food idea to market is through the newly revamped Recipe to Market program, which will be held in Tillamook County Feb. 20, 21 and 22, 2019. In addition, OSU Extension will hold a free Farm-Direct class on Feb. 2.

“Local foods are a big draw; more and more visitors are seeking out food experiences when in Tillamook County and on the Oregon Coast,” said Nan Devlin, tourism director for Visit Tillamook Coast. “Not only do guests want to taste, catch, harvest, sip and cook local specialties while here, but they want to buy food as gifts, and order more once they get back home.”

Partners for Rural Innovation has collaborated on restarting the Recipe to Market program. With assistance from a Business Oregon Rural Opportunity Initiative grant, workshops on Farm-Direct essentials, food safety and production, business development and marketing will be held in Tillamook County at a substantially reduced cost.

In the past, this program has cost $400; however, because of the grant from Business Oregon the two-day program is just $50, and the Farm-Direct Essentials workshop is free. Register at https://tillamookcoast.com/recipetomarket

Food entrepreneurs throughout the Oregon Coast are welcome to take part.

“If you are thinking about developing a food product, have one underway, or already have afood product and want to learn more or update your skills, this is a good time to sign-up forRecipe to Market,” said Devlin. “At just $50, it’s very affordable.”

On Feb. 2, Kelly Streit, of OSU Extension Service in Clackamas County, will lead a Farm Direct “Field to Market” essentials workshop for small farmers wanting to create products for onsite sales. It will be held at the Partners for Rural Innovation Building, 4506 Third Street, Tillamook, from 10am to 2pm. Lunch will be served.

On Feb. 20 and 21, Sarah Masoni, known as the woman with the “million-dollar palate,” will bring her renowned Food Safety and Preparation program to Tillamook. This important class is usually held at Portland’s Food Innovation Center, but instead, Masoni will hold the one-day workshop on Feb. 20, and repeated on Feb. 21, at the 4-H building at Tillamook County Fairgrounds. Participants can sign up for either day.

On Feb. 22, the second part of the Recipe to Market program will be held at the Partners forRural Innovation building at 4506 Third Street, right across the street from the 4-H center. This one-day workshop will include information and assistance with business planning and marketing, as well as a panel discussion with locals who have brought a food product to market.

Each one-day Food Safety and Production workshop from the Food Innovation Center is limited to 20 people, for a total of 40. The business and marketing workshop will bring everyone together in an interactive session.

Business planning will be facilitated by Arlene Soto, director of the Small Business Development Center, and marketing will be taught by the staff of Visit Tillamook Coast. There will also be information shared about financing and loan opportunities. In addition, a Spanish-language version of the Recipe to Market program will be offered in early spring if there is interest in the community.

Register at: https://tillamookcoast.com/recipetomarket

For more information, call or email Nan Devlin at 503 842-2672 or nan@tillamookcoast.com

We’re Moving!

The Tillamook County Creamery Association recently released their plans to build a brand new visitors center, which will be begin next Spring. This is a very exciting development for our community that will enhance the current experience for our visitors and add more capacity for destination spending.

It also means that we have to move. When you look at the plans for their new Visitor’s Center, which will be nearly 50 percent bigger than the current building, it is quite apparent that they will also need to redesign the flow of their parking lot and can no longer accommodate our building. We’ve been blessed with this location for several years now and it has served us well, but we’re excited about the new opportunities both for the Creamery and the Chamber.

Now for the really exciting part! We are moving back to downtown Tillamook!

Thanks to a considerable financial contribution from the Creamery, we were able to obtain financing to purchase the building at 208 Main Avenue, where Bells Office Supply currently resides. The generosity of the Creamery’s leadership and its Board of Directors has been phenomenal, and we wouldn’t have been able to relocate without their help. Even though they had no obligation to help us, they stepped forward in a very generous way and we are so grateful for their support.

We were able to buy the building from its owners, who have operated Bells Office Supply since 2004. Many of you may know Scott and Mary, who were excited to sell the building to the Chamber and are still contemplating where they will relocate. Scott and Mary have a valuable service to the community and we are going to make sure we do what we can to minimize impact on their business.

So what does all this mean for you? Why is it so exciting to have the Chamber back downtown? It means being able to better assist downtown customers; it means better business relations; and it means bringing the positive energy of having a Chamber in the core of downtown.

We have some exciting additions beyond visitor information for the new location, including a small retail space upfront to highlight locally-made products, a large meeting space and a business lounge.

Wait, what’s a business lounge? It’s a comfortable, open area with tall tables and comfortable seating that allows people to come in and meet with colleagues or clients. It’s perfect for those people who find themselves in town for business or in-between meetings and would love to have a landing place to do some work for a bit or get online. It will be especially beneficial for those businesses that don’t have a brick and mortar location, such as photographers, independent contractors, and so forth.

And while we will miss the opportunity to further assist visitors at the Cheese Factory, the Creamery has announced it plans to include a space for mini “visitors’ information center” inside the new facility.

Overall, I believe this is a positive change for our community and we are eagerly awaiting our move-in date this Winter. There will be a remodel phase, but I hope you’ll stop in and say hi.

The Chamber Board and myself value your input and insight. Feel free to contact us anytime at info@tillamookchamber.org.

Chamber Chatter: Welcome to the team, Sierra

It is with great excitement that I announce the addition of a new, full-time employee here at the Chamber. I hope you will all join me in welcoming Sierra Lauder as the Director of Events and Downtown Development.

You may be asking yourself: Why this is such a big deal? I’ll tell you why: for the past five years I have seen what the Chamber has been able to accomplish with just two staff people and our many volunteers, and I can’t help but get excited thinking of what we can accomplish by adding Sierra to our ranks.

Sierra has her Bachelor’s degree is Social Science with an emphasis in Rural Studies and Political Science. For her senior project she wrote a grant, so we are thrilled to have her grant writing experience at the Chamber. She is an avid volunteer and sees the value in community engagement.

Sierra has worked for non-profits, government agencies and small businesses and appreciates the pros and cons of each realm. In her own words she said “I am very excited to tackle this new role that allows for me to indulge my creative energy in event development and implementation while humoring my passion for public process and civic engagement.”

Sierra has lived in Tillamook County for the last 15 years and spent the first 12 in south Tillamook County. She and her kids are often present at many community events and have enjoyed the family-friendly nature of these events. Sierra says, “I am hopeful that, as a team, we are able to continue to grow and expand those events in a sustainable way, utilizing lots of volunteer energy… I look forward to hearing the great ideas circling and finding ways to actualize them in alignment with the goals and strategic plans that exist for the downtown area.”

Sierra’s role will work very closely with the City of Tillamook as she will be managing the Main Street program on a daily basis in downtown Tillamook. If you are a downtown business owner, it is our hope that you will come to know Sierra very well. It is one of her intentions to be accessible and approachable as possible and to be a resource to you. If you are a small business owner you know that securing grant funding and complying with ordinances can be overwhelming sometimes, and one of Sierra’s roles will be to assist in increasing accessibility and providing support for businesses that are looking to grow and/or establish themselves within the community.

“I love the character of our downtown district,” she said, “and I am so looking forward to getting to meet you all in the coming weeks.”

The community is fortunate to have Sierra at the Chamber, and I look forward to seeing her energy and skills be used to make Tillamook a better place to live and do business. Monday, October 3 was her first official day on the job and she already had a to-do list that she put together with little direction from me.

If you would like to get involved in downtown Tillamook events, or just want to welcome Sierra to the team, you can reach her at sierra@tillamookchamber.org or call 503-842- 7525.

Time to Nominate your Favorite Business

School is back in session, the days are getting shorter and there is a cold nip in the air. Yes, it must mean that fall is upon us. That time of year when we gather together with our families around our favorite foods, uphold traditions, exchange gifts, and remember what we are thankful for.

It’s also time to pause and reflect on those in the community who have had a positive impact on our lives, and that we would like to say “thank you” to. Tillamook County has had a great deal of change and growth this year, and it’s been exciting to watch and enjoy the benefits of these new additions to our area.

Which is why each year in January, the Chamber recognizes those businesses, organizations, and people who have helped make Tillamook a special place to live. At our annual banquet we hand out awards in five categories: Business of the Year; Small Business of the Year; Development Project of the Year; Citizen of the Year; and Junior Citizen of the Year (under 20). Our purpose is to say thank you, and to let all those nominated know that we appreciate and value their time, commitment, and investment in our community.

But in order to hand out these awards, we need you – the community – to make your nominations. This is your chance to say thank you to those businesses and organizations that have made a difference in your life. Let’s let them know how much we appreciate their hard work and the efforts they make each and every day to enhance our lives.

If you yourself are a businesses owner you know that compliments and appreciation can sometimes be few and far between, but they go along way. So I’m encouraging everyone – whether you are a business owner, employee, volunteer, or just someone who calls this place home – to take some time and nominate your favorite businesses and those making positive improvements to our area.

Nomination forms are available at tillamookchamber.org/awards or at the Chamber of Commerce Visitor Center. Applications must be in by Dec. 20, 2016.

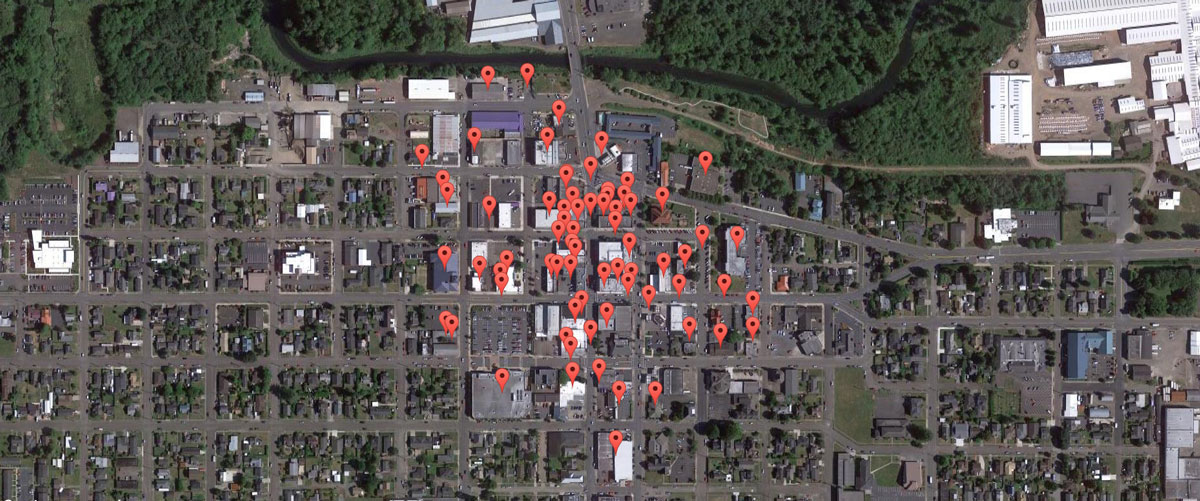

Downtown walking maps aim to increase visitor spending

Last winter, the Tillamook Area Chamber of Commerce was fortunate enough to receive a Tourism Promotions Grant from Visit Tillamook Coast to create a downtown walking map. Our goal was to produce a tool that would generate more foot traffic in the heart of Tillamook.

The rational behind these maps is that people shopping downtown – particularly visitors to the area – aren’t aware of how many different types of businesses are just within walking distance.

As you probably, know, our downtown has a lot to offer. From frozen yogurt to gourmet cupcakes, yarn and fabric stores, handmade soaps, florists, and vintage thrift shops… There are all kinds of things to explore and do in an afternoon.

And one thing our downtown business owners continue to be great at is interacting with their customers and making sure they know of other nearby places to visit. Now, thanks to the downtown walking map, they have a convenient tool they can reference and that helps visitors gain a better picture of our downtown.

Jackie Ripley, who co-owns Madeline’s Vintage Market Place on Third Street, said that her customers have responded positively to the new map – particularly those from out of state.

Jackie is one who has always done a great job of recommending her fellow downtown business (such as Sunflower Flats, Blue Moon Café, and the Phoenix Exchange) to her customers depending on what else they’re looking for. Now, she said she can easily show them how to get anywhere in downtown Tillamook.

And, she’s had several people in her shop who found her thanks to the downtown walking map.

Along with a printed version that can be picked up for free at the Chamber Visitor Center and different downtown business, there is also a web-based version available at www.gotillamook.com under the ‘downtown’ menu.

The web-based map utilizes GPS and the location services available on mobile devices to direct mobile users easily throughout the downtown area. Users can enter their location and see exactly how close they are to different downtown businesses. It also lets user search for what type of business they’re looking for. So whether it’s a cup of coffee, a place to eat, a manicure or an ice cream cone, the map lists the different options available, as well as how far away they are, addresses and phone number. Users can click ‘take me there’ which redirects to Google maps with an exact walking route to their destination.

This new downtown walking map is a free service for Chamber members in downtown. Other businesses can have their listing added to the map for a small fee by contacting the Chamber at the email below.

The Chamber Board and myself value your input and insight. Feel free to contact us anytime at info@tillamookchamber.org.

5 Benefits to being a Chamber Member

Here is a question I hear a lot: “why should I be a member of the Tillamook Area Chamber of Commerce? What’s in it for me?”

It’s a valid question. If you’re spending money on any service, you want to know that it’s working for your business and making a difference. So here are five benefits your business could experience right now by being a member of the Chamber today:

- As a Chamber member, we are here to be the best resource possible for you and your business. Admittedly the Chamber cannot help you with everything, however we are positive we can help point you in the right direction. Although we will help anyone and everyone, being a member clearly puts you at the top of our to-do list. We partner with different agencies to bring business development trainings to our area and will be expanding this service over the next year. And, in the near future we will be offering assistance to help member businesses write and obtain local grants. As a member you are the first to know about these programs and will receive discounted registrations, or be able to attend for free in some cases.

- Enhanced Livability. The intangible benefit of becoming a Chamber member – yet the most beneficial – is being the financial support that allows the Chamber to continue to do the work in the community that we do for the good of everyone. This includes organizing events such as the Cork & Brew and the June Dairy Parade. It means designing the downtown walking map and new Tillamook Living Calendar. It also means addressing community needs – like working with ODOT on local traffic issues and organizing the downtown cleanup. There are a significant number of things the Chamber is involved in that enhance the livability of our community. A financial contribution in the form of Chamber membership supports all of these things and more. Together we are making our community a better place to both live and spend money.

- Having an Advocate. You’re probably too busy to keep up with everything that happens in government – both locally and statewide. And that’s OK. Being a Chamber member means you always have an advocate in local and state-wide government issues. We work to create a balanced dialogue between government and the business community. We always advocate for free enterprise and oppose new taxes and fees that are aimed directly at businesses. You can rest assured that you will have a voice in issues that affect you.

- Direct referrals. It may be hard to believe in this Internet age where Google is a household name, but often when people are looking for a particular type of business, product, or service they contact the Chamber. We get calls from people every day inquiring about potential vendors. A primary group we hear from are local businesses asking if anyone in the area provides what they are looking for. We may be a small community, but that doesn’t mean everyone knows everything about the business community and what is available. As a Chamber member, you have more opportunities to gain these valuable referrals, both from the Chamber directly and other Chamber members.

- Indirect referrals and visibility. Not to devalue the last point, but membership is relatively inexpensive, averaging from $195 to $330 per year. The amount of visibility you receive online and in print is the best exposure you can spend your advertising dollar on. We say that with confidence! Your business is included in three different online directories, receiving tens of thousands of visits. This helps your own business website retain a higher listing on Google searches. Our membership directory is also printed in 100,000 visitor guides each year, and we have another local publication in the works. And for those who thrive from tourism, don’t forget that Chamber members can display their marketing materials in the Visitor Center. We love knowing that whether you provide a local service or a tourism-related service, we are your best investment dollar for dollar.

Those are just five ways you generate more income for your business by being a Chamber member. I would love to talk to you more about other ways the Chamber can help your business thrive. If you have questions or would like a membership application please email us below.

The Chamber Board and myself value your input and insight. Feel free to contact us anytime at info@tillamookchamber.org.